About

The team Spatial Economics specializes in spatial economic and multi-disciplinary modeling to provide a comprehensive understanding of energy system transformations.

Research Topics

We explore how energy transition processes affect economies on various regional levels, analyzing their implications for stakeholders and offering insights to inform science and society. With foundations in economics, econometrics, and policy assessment, we develop tools for providing levers that facilitate smooth energy system transition pathways aligned with climate goals and stakeholder demands. Applying cross-sectional and panel data for Germany, the EU, and international contexts, our analyses give insights into e.g. regional economic expansion potential of renewables, multi-regional decision analyses, and provide distributive assessments for energy technologies from an economic perspective. Our audience includes scientists, policymakers, and decision-makers seeking informed strategies for navigating energy transitions and transformation processes.

Team Members

HIM (Hydrogen Investment Model)

What is HIM:

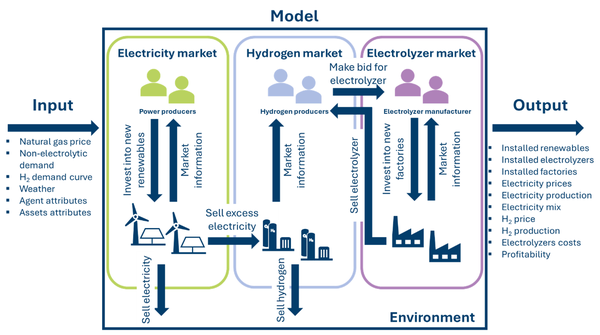

HIM (Hydrogen Investment Model) is an agent-based model designed to explore how a green hydrogen industry could develop in Germany. The model simulates (strategic) investment decisions made by various actors – such as electricity producers, hydrogen producers, and electrolyzer manufacturers – and takes into account the sectors of renewable energy, green hydrogen, and electrolyzer production. The goal of HIM is to better understand the conditions under which a profitable domestic hydrogen industry can be established. Based on this understanding, more realistic targets for the green hydrogen economy can be set, and potential bottlenecks, such as the availability of electrolyzers, can be identified early. The model is currently being further developed to consider different funding and subsidy programs. At its core, HIM is a NetLogo model, supplemented by Python scripts. The entire model is freely accessible and available as an open-source project.

How to use HIM:

The Git repository contains comprehensive, up-to-date documentation as well as detailed explanations of the model's functionality. Additionally, there is a folder with all the necessary files to reproduce the results of our paper.

Functionality of HIM:

HIM enables the simulation of how the green hydrogen industry in Germany could develop under various conditions. The model considers three types of actors: electricity producers, green hydrogen producers, and electrolyzer manufacturers. It also includes three types of assets: renewables, electrolyzers, and factories for electrolyzer production. The actors make investment decisions based on the net present value method, with the possibility to also consider strategic investment decisions. In addition to its core functionality, HIM offers routines for sensitivity analysis and the calculation of different scenarios. Furthermore, it allows for the parallel computation of multiple simulation runs.

Results of HIM:

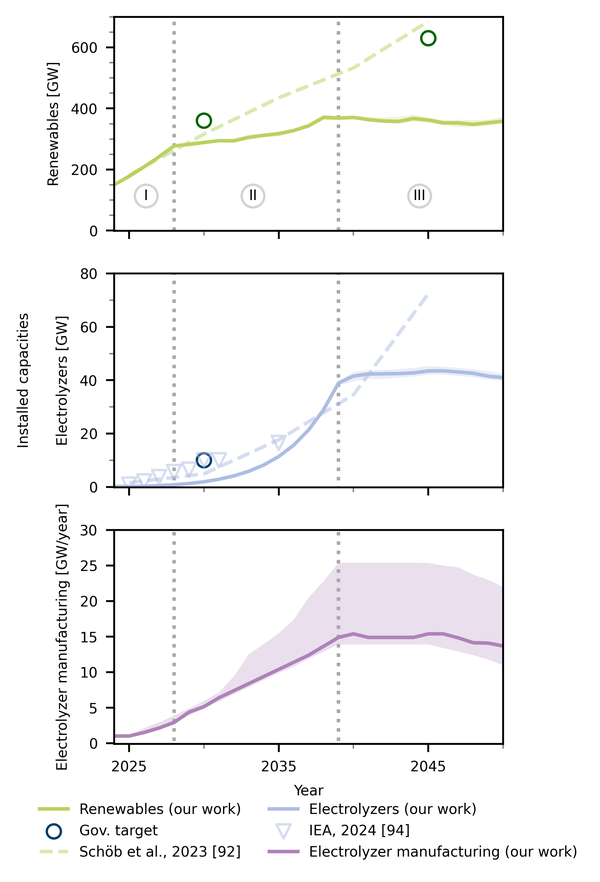

In the best-case scenario, where there is a high willingness to pay for green hydrogen and for strategic investments, a successful domestic hydrogen industry could develop in Germany over time, with around 40 GW of installed electrolyzers by 2050. However, the scale-up of this industry is too slow to meet the government's targets for installed electrolyzers. The expansion only truly begins once electricity demand is already covered by approximately 80% renewable energy. This state will be reached even without the green hydrogen industry, as renewable energies will remain profitable up to that point, even without the additional demand for excess electricity from green hydrogen production. Electrolyzer manufacturers, due to their cost structure, can begin to build production capacities early and thus secure market shares. Through the expansion of electrolyzer capacities, production costs can be reduced by approximately 57%, from 2,500 €/kW to 1,070 €/kW, but they will still remain higher than the values commonly cited in the literature. The Levelized Cost of Green Hydrogen (LCOH) in the best-case scenario will decrease to about 3.25 €/kg by 2050. While this is significantly cheaper than current costs, it is still more expensive than hydrogen produced from fossil sources. The expansion of the domestic hydrogen industry would also have positive effects on electricity consumers, as the increased demand for renewable energy is expected to lower electricity prices. Overall, the best-case scenario would result in approximately 306 billion euros more investments by 2050 than a scenario without a green hydrogen industry.

Current Paper: